U.S. banking system ‘extraordinarily’ sound – really?

Jamie Dimon is Chief Executive Officer of JPMorgan Chase, the largest U.S. bank with over $3.7 trillion in global assets and the world’s largest bank by market capitalization, i.e., stock value. Dimon made headlines May 1, with a pronouncement: “The American banking system is extraordinarily sound.”

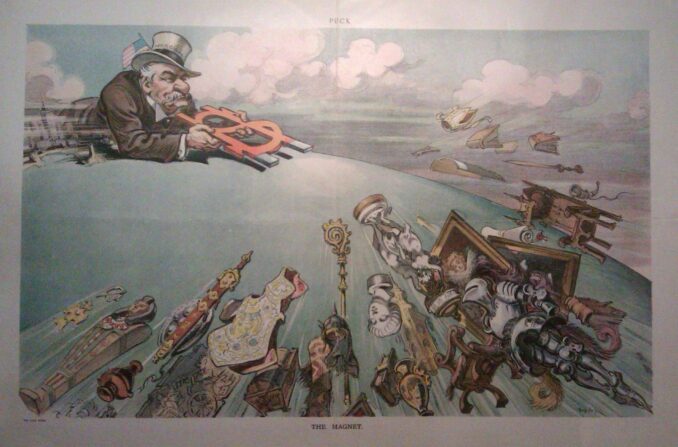

A 1911 cartoon depicts a giant J.P. Morgan sucking in treasures from global peoples and cultures.

Dimon had reportedly stayed up all night making JPMorgan Chase an even bigger bank, by buying the failing California-based First Republic Bank at a rock-bottom price. By April 24, First Republic became the second-largest bank failure in U.S. history, after uber wealthy depositors like Meta CEO Mark Zuckerberg yanked over $104 billion out of the bank in just a few weeks. (Technology conglomerate Meta owns Facebook and Instagram.)

These rapid withdrawals drove First Republic’s stock price down 97% to near worthless, resulting in its seizure by bank regulators.

This is Dimon’s world, where a run on a bank was driven by the richest of the rich panicking. This moved unimaginably more wealth into the monopoly vaults of JPMorgan Chase, which Dimon characterized as just another “extraordinarily sound” day at the office.

The first second-largest bank collapse ever

Just two months earlier on March 8, Silvergate Bank, whose depositors were invested heavily in cryptocurrency, went belly-up after a Bitcoin dive.

Then on March 10, the first “second-largest bank failure in U.S. history” occurred, when regulators and the Federal Deposit Insurance Corporation (FDIC) declared Silicon Valley Bank (SVB) insolvent following a classic bank run. This run featured the spectacle of wealthy depositors, business owners, foundation executives and real estate developers – for-profit and nonprofit alike – lining up on sidewalks on both U.S. coasts in abject fear of losing their deposits. (Workers World, March 13)

Immediately following SVB’s seizure, Signature Bank collapsed March 12, in the wake of last fall’s implosion of the world’s then-largest crypto-exchange, FTX. Last year FTX founder Sam Bankman-Fried was feted at the White House and on Capitol Hill. Today he’s a scapegoat, under federal arrest for financial crimes and facing a potential life sentence.

Yellen: ‘Banking system is safe and sound’

Following the First Republic takeover, the “extraordinarily sound” bank collapses continued like slow-motion dominoes, when Pacific Western Bancorp, another regional bank, announced May 11 that its stock price had dropped nearly 25% overnight, down 80% since January 2023. This occurred after tens of billions of dollars of deposits recently fled to bigger banks like JPMorgan Chase.

Other medium-sized regional banks, including Zions Bancorp and Western Alliance, are reportedly experiencing similar deposit outflows and stock-price tremors.

President Joe Biden’s Treasury Secretary Janet Yellen, formerly chair of the Federal Reserve Bank, had issued her own soothing statement that the banking system is “safe,” “sound” and “resilient,” in a joint release by Treasury, Federal Reserve and the FDIC March 12. Yet she ordered the rules for deposit insurance changed to cover jumbo clients with accounts over $250,000. Jumbo mortgages and deposits exceed Federal Housing Finance Agency limits and are currently not guaranteed.

Yellen strong-armed her banking allies into ponying up tens of billions of dollars to essentially bail out JPMorgan Chase, which had assumed much of the jumbo low-interest mortgage debt, and other liabilities and many jumbo deposits from this season’s failed banks in its frenzy of crises-driven monopoly acquisitions.

Despite their optimistic forecasts, Yellen and Dimon are aware that the U.S. finance system is quickly running out of bail-out money. Their recent utterances, mostly off newspaper front pages tucked in the business sections, have all included the words “panic,” “sadness,” warnings of impending “catastrophe” and news of the creation of a “war room” at JPMorgan Chase’s Park Avenue headquarters. (Reuters, May 11)

Only workers produce value

A fundamental problem for the bankers, often hidden amid the reams of bourgeois journalism and arcane economic data about interest rates, rates of profit, debt default and Wall Street’s pseudo-theories, is that workers are the only class in the capitalist economy who produce value. Profits are based on workers’ unpaid labor — surplus value — and that includes the share of profits that goes to the bankers.

The fortunes of the capitalist class are for a time augmented by Wall Street gambling, speculation and criminal activity, ultimately resulting in multiple bubbles of unprecedented debt, in relentless but futile pursuit of ever higher wealth.

When capitalist bubbles burst, the working class pays the price. The Boston Globe noted May 11: “The number of Americans filing for unemployment benefits last week rose to its highest level in a year-and-a-half, though jobs remain plentiful by historical standards, even as companies cut costs as the economy slows.”

Bankers are attempting to manipulate interest rates to lower inflation as a tactic to prevent workers from demanding and winning wage increases and improved benefits. By doing this, however, bankers create the conditions for their own internal balance sheet crises and for increased workers’ resistance.

In the U.S., young workers in rebellion at Starbucks and Amazon, Teamsters building for a potential strike at UPS, writers on strike in Hollywood and teachers at school districts and universities should know the leading role of JPMorgan Chase and other banking monopolies in fomenting austerity, war, mass layoffs and union busting.

What is “extraordinarily sound” is the growing working-class consciousness that these bank monopolies must be overthrown and totally replaced by a socialist system of production, owned and compassionately but forcefully controlled by the working class and oppressed peoples, organized, planned and run for the equal benefit of all.

For further background: “Top banker says, An economic ‘hurricane’ is coming – Workers of the world, time to get ready to fight!” by Larry Holmes, Workers World, June 20, 2022.